Chairman’s Comments: UK Interest Rate Cut

Our Chairman David Atherton gives his thoughts on today’s decision to cut UK interest rates exclusively to our website.

Please see David’s remarks below.

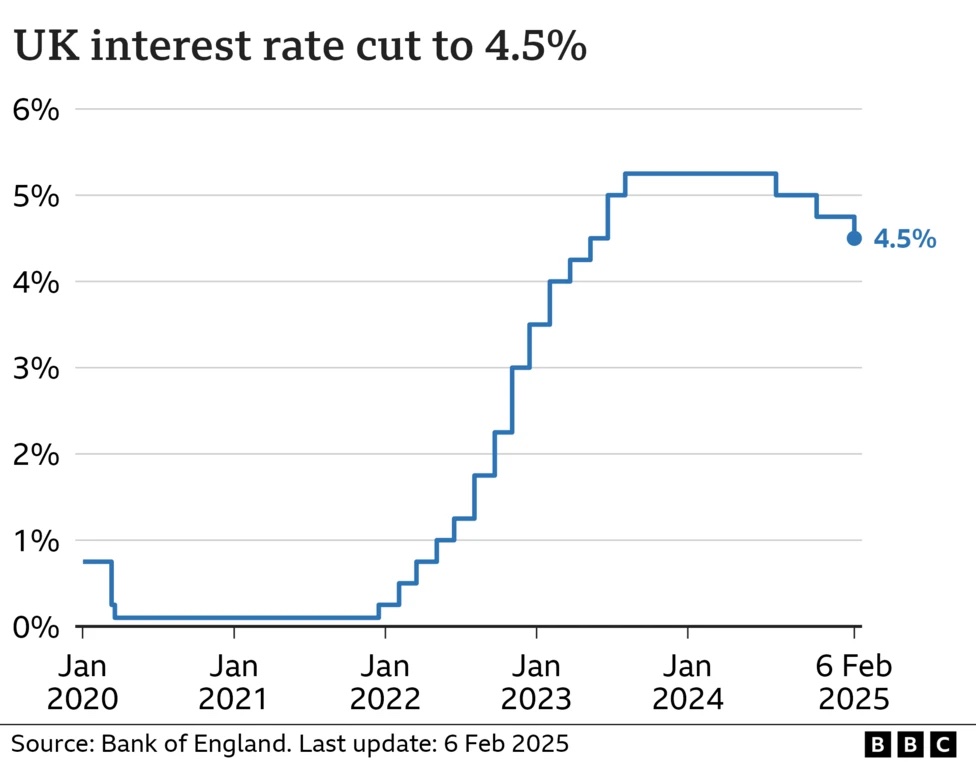

The Bank of England cut the UK base rate today by 0,25% from 4.75% to 4.50%, the lowest level for 18 months, and the third cut since August 2024. This is in line with expectations, however analysts only expected eight of the Bank’s nine Monetary Policy Committee to vote for a cut, when all nine did, and in fact two voted for a 0.50% cut. This indicated that the pace of future cuts may be faster than previously thought, so the pound fell on the news, at one point reaching a 1% daily drop against the dollar, although it rallied back later in the day.

The Bank also halved its growth forecast for 2025 from 1.5% to 0.85%. and also warned that rising utility bills and possible US trade tariffs could push inflation up to 3.7% from the current 3.2%. Despite this Governor Andrew Bailey said that the bank was looking at further cuts, but would have to judge this meeting by meeting.

The UK stock market reacted positively, with a spike up on the news, although like the pound, this move was partially reversed as the day went on, but nevertheless the FTSE 100 closed at a record high.

MHW Chairman said “more good news for borrowers, both individuals with mortgages and also industry, which of course should reflect well in the value of shares in our client’s portfolios.”

For further information see https://www.bbc.co.uk/news/articles/cd75yq1zlzqo

MHW work in partnership with many of the premier global investment managers and as further commentary and analysis is available, we will be privileged to share this with our clients. If you wish to talk to an adviser about the effect on your personal position, please get in touch.