Chairman’s Comments: UK Interest Rate Cut to 3.75%

Our Chairman David Atherton gives his thoughts on today’s decision to cut UK interest rates exclusively to our website.

Please see David’s remarks below.

18 December 2025 14:35

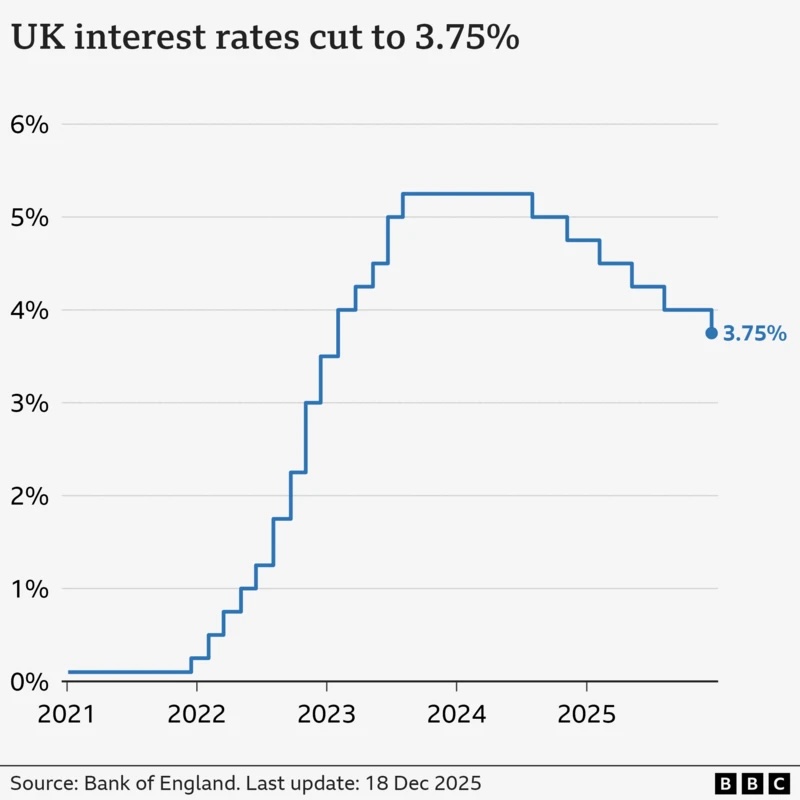

As expected, and as we predicted last month, The Bank of England today cut the UK Base Rate by 0.25% to 3.75%. Although the cut was widely expected, in the end the nine-person Monetary Policy Committee were on a knife-edge, with five voting for the cut, and four for remaining at 4.00%

Bank of England Governor Bailey said that rates are “likely to continue on a gradual downward path”. He did however indicated that cuts next year may be slower. He said “how much further we go becomes a closer call”.

These remarks, and particularly the very close vote was immediately seen by markets as hawkish (ie less likelihood of future cuts than before), and the FTSE100 and FTSE250 share indices immediately dropped by 1%, a relatively large reaction. Similarly the pound quickly rose by 0.34% against the dollar and 0.38% against the euro, and 10-year gilt yields rose from 4.45% to 4.52%. As always these price moves are inside the range of the last few days, and, as usual have started to revert to norm at the time of writing.

Following yesterday’s surprise lower CPI inflation figure (3.2% vs 3.5% expected)—which would have been too late to affect the vote—Governor Bailey also said that he expects inflation to fall to the Bank target 2% next summer, rather than his previous forecast of 2027.

Further information can be found at the BBC website here https://www.bbc.co.uk/news/live/cn4d8p1gj2et whose chart we have used

MHW Chairman, David Atherton said “So we can assume that the cuts will slow down in 2026, no longer being every other meeting as they were in 2025, and almost certainly not at the next meeting on 6th February. Nevertheless the trend is down which is good news as I always say because it makes mortgages cheaper, and cuts are (eventually) good for share prices in ISAs and pensions.

I should also say that foreshortened CPI inflation target date is also good, and if it continues to fall quickly, say, comfortably under 3%, there is small possibility of a cut on March 20th.”

This is our Chairman’s personal opinion and does not constitute financial advice. MHW work in partnership with many of the premier global investment managers and as further commentary and analysis is available, we will be privileged to share this with our clients. If you wish to talk to an adviser about the effect on your personal position, please get in touch.