Chairman’s Comments: UK Interest Rate Held at 4.00%

Our Chairman David Atherton gives his thoughts on today’s decision to hold UK interest rates exclusively to our website.

Please see David’s remarks below.

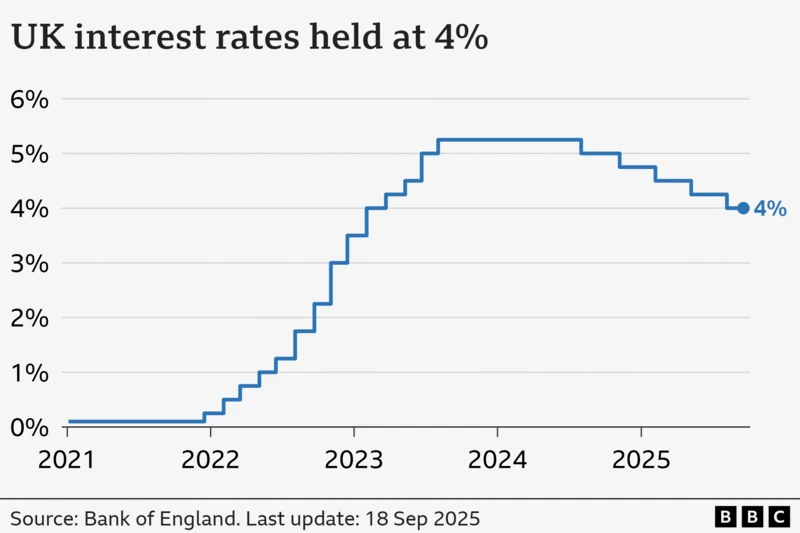

In a widely expected move, The Bank of England today held the UK Base Rate at 4.00%. The vote of the nine-person Monetary Policy Committee was 7-2 as expected, with two members voting for a cut. The committee “judged that a gradual and careful approach” to the further rate cuts “remained appropriate”, a point amplified by Bank of England Governor Andrew Bailey who, referring to inflation, said “we’re not out of the woods yet”. Yesterday’s UK inflation release was 3.8% year-on-year, well above the Bank’s 2% target.

In a technical move, the Bank also announced a slower unwinding of the quantitative easing (QE) programme built up in the near-zero interest rate years. This ‘un-printing of money’ strengthens the pound so slowing down weakens it. This is a small issue, proved by the fact that there was virtually no movement in the UK 10-year (gilt) bond yield.

Confirmation of the long term downtrend, and the QE slowing caused a very small dip in sterling versus the dollar and the euro, and slight uptick in the FTSE 100 share index. But these were only within today’s range, the pound/dollar had been rising all morning. In other words, as expected, no real effect.

There is further information at https://www.bbc.co.uk/news/live/c62ldgvl24et whose chart we have used.

MHW Chairman, David Atherton said “This was no change, exactly as expected. The inflation release yesterday was 0.1% higher than expected, and the trend, since the October 2024 low of 1.7% has been upwards, so a cut would have been extremely unlikely. The Bank has at other times said they expect the CPI inflation rate to peak at 4% before falling again, so it looks like we are nearly there.

The key point is that the downward path is confirmed (although not this month, and probably not in 2025), which is good news for both personal and business borrowers, and as many mortgage holders are also savers, release more money to save.”

This is our Chairman’s personal opinion and does not constitute financial advice. MHW work in partnership with many of the premier global investment managers and as further commentary and analysis is available, we will be privileged to share this with our clients. If you wish to talk to an adviser about the effect on your personal position, please get in touch.