Chairman’s Comments: UK Interest Rate Held at 3.75%

Our Chairman David Atherton gives his thoughts on today’s decision to hold UK interest rates exclusively to our website.

Please see David’s remarks below.

5 February 2026

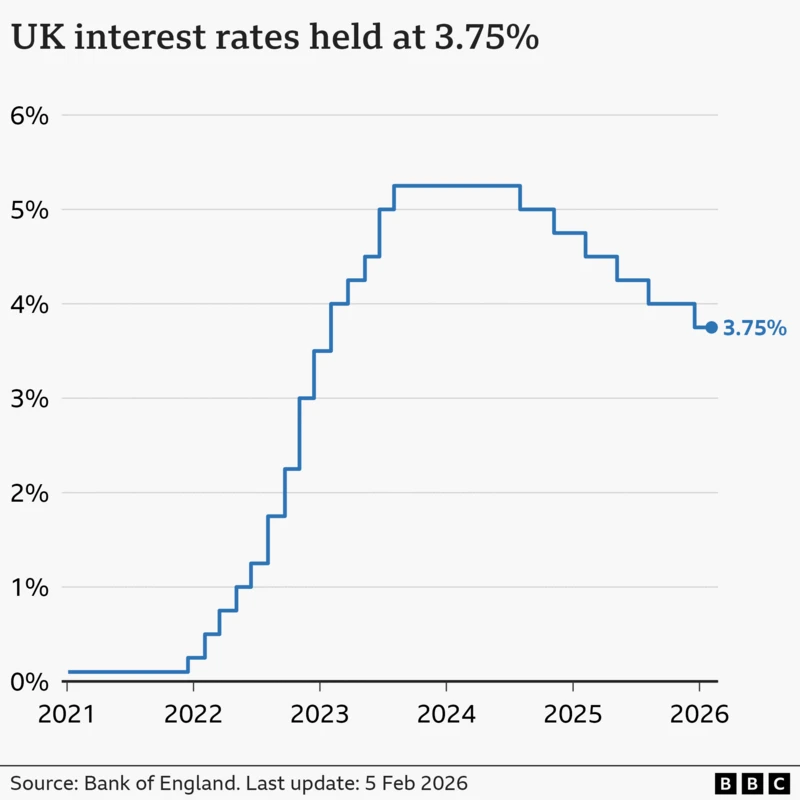

As expected, The Bank of England today held the UK Base Rate at 3.75%. The vote of the nine-person Monetary Policy Committee was close at five votes to hold and four for a cut. The expectation was seven votes to three to hold.

Governor Andrew Bailey repeated his message from December said that the Bank thinks inflation has peaked, and should return to its 2% target in 2026. However he also repeated the December message that although there is still a downward trajectory (further cuts), that these would be more measured (less frequent).

This was all seen as dovish (indicative of lower rates sooner) by the markets, although the effect was less than that in Novembers “dovish hold”. UK 10-year bonds hardly moved, with yields falling slightly, but still above yesterday’s low. The pound fell about 0.5% against the dollar and the euro, but always then started to recover. The FTSE100 index added 0.45% but lost all that gain within 30 minutes.

There is further information on this at https://www.bbc.co.uk/news/articles/czx1vly05pvo whose chart we have used.

MHW Chairman, David Atherton said “The outcome was expected. The Bank is very consistent about their messaging, in that things are getting better, but rather slowly.

I was surprised at the 5-4 vote, given the higher than expected January 21st inflation figure (3.4% vs 3.3% expected). This was the same ratio as November, and a cut came the following month. So I reiterate what I said in December, a March cut to 3.50% seems on the cards”

This is our Chairman’s personal opinion and does not constitute financial advice. MHW work in partnership with many of the premier global investment managers and as further commentary and analysis is available, we will be privileged to share this with our clients. If you wish to talk to an adviser about the effect on your personal position, please get in touch.