Chairman’s Comments: UK Interest Rate Held at 4.00%

Our Chairman David Atherton gives his thoughts on today’s decision to hold UK interest rates exclusively to our website.

Please see David’s remarks below.

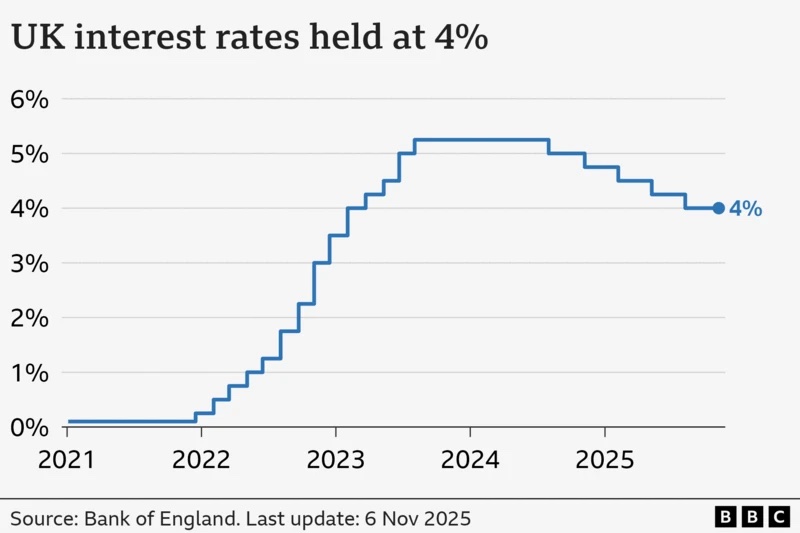

As expected, The Bank of England today held the UK Base Rate at 4.00%. The vote of the nine-person Monetary Policy Committee was close at five votes to hold and four for a cut. The expectation was six votes to three to hold.

Governor Andrew Bailey importantly said that the Bank thinks inflation, currently running at 3.8% has peaked, and should return to its 2% target by 2027. The implication is that there will be further cuts, probably as soon as the next meeting on December 18th.

This was all seen as dovish (indicative of lower rates sooner) by the markets, and notably, there was a sharper movement than normal in markets with sterling immediately moving down 0.25%, the FTSE 100 climbing by 0.20%, and UK 10-gilts rising by 0.65%, although, as always, all these moves reversed to some extent in the next hour.

There is further information on this at https://www.bbc.com/news/live/c5yd94g13e9t whose chart we have used.

MHW Chairman, David Atherton said “The outcome was expected, but when the BoE says inflation has peaked, today can definitely be seen as good news.

I said on Sep 18th that the next cut might not come in 2025, I now think that it will. Lower rates are always better, both for mortgage holders (obviously) and stocks and shares ISA and pension investors (as cuts are good for share prices, and lower mortgages release more money to save). So I view today as positive not neutral.”

This is our Chairman’s personal opinion and does not constitute financial advice. MHW work in partnership with many of the premier global investment managers and as further commentary and analysis is available, we will be privileged to share this with our clients. If you wish to talk to an adviser about the effect on your personal position, please get in touch.