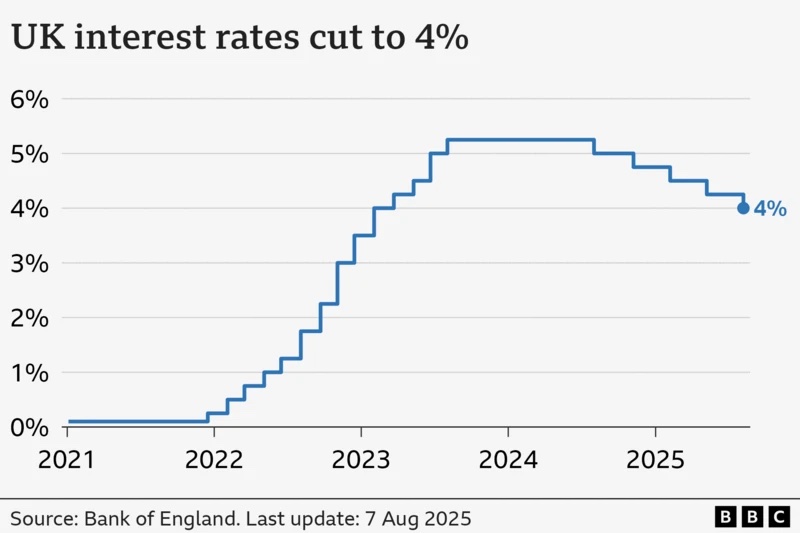

Chairman’s Comments: UK Interest Rate Cut to 4.00%

Our Chairman David Atherton gives his thoughts on today’s decision to cut UK interest rates exclusively to our website.

Please see David’s remarks below.

As predicted, the Bank of England cut the UK base rate today to 4.00%. The vote from the nine-member Monetary Policy Committee went to an unprecedented second vote, in the end it was very close, with five votes for the cut, and four wanting to hold the rate at 4.25%. This close call resulted in an immediate reaction similar to rate rises, the pound spiked up 0.25% against the dollar and euro, and the FTSE100 fell slightly. Note these immediate moves are quite small and often reversed.

BoE Governor Bailey called the decision “finely balanced”, and although confirming that rates “are still on a downward path”, future cuts will need to be made “gradually and carefully”, hinting perhaps to a slowing of the downward trajectory.

The notable recent effect has been an increase in savings, suggesting consumers have less confidence to spend. This of course correlates with the anaemic growth levels seen in the economy.

There is further information on this at https://www.bbc.co.uk/news/live/cedvn267z0jt whose chart we have used.

MHW Chairman David Atherton took a similar view to the previous rate cut. “The cut is good for mortgage payers of course, and the downward rate trend is surely part of the excellent performance of stocks and shares this year, for example the FTSE100 index is 20% up since the Trump tariff low just three months ago, and only 1.15% off an all-time high.”

This is our Chairman’s personal opinion and does not constitute financial advice. MHW work in partnership with many of the premier global investment managers and as further commentary and analysis is available, we will be privileged to share this with our clients. If you wish to talk to an adviser about the effect on your personal position, please get in touch.